After your Glomo account is activated, you can begin accepting live payments. Each payment attempt made by a customer is recorded as a payment entity, representing their effort to complete the transaction.

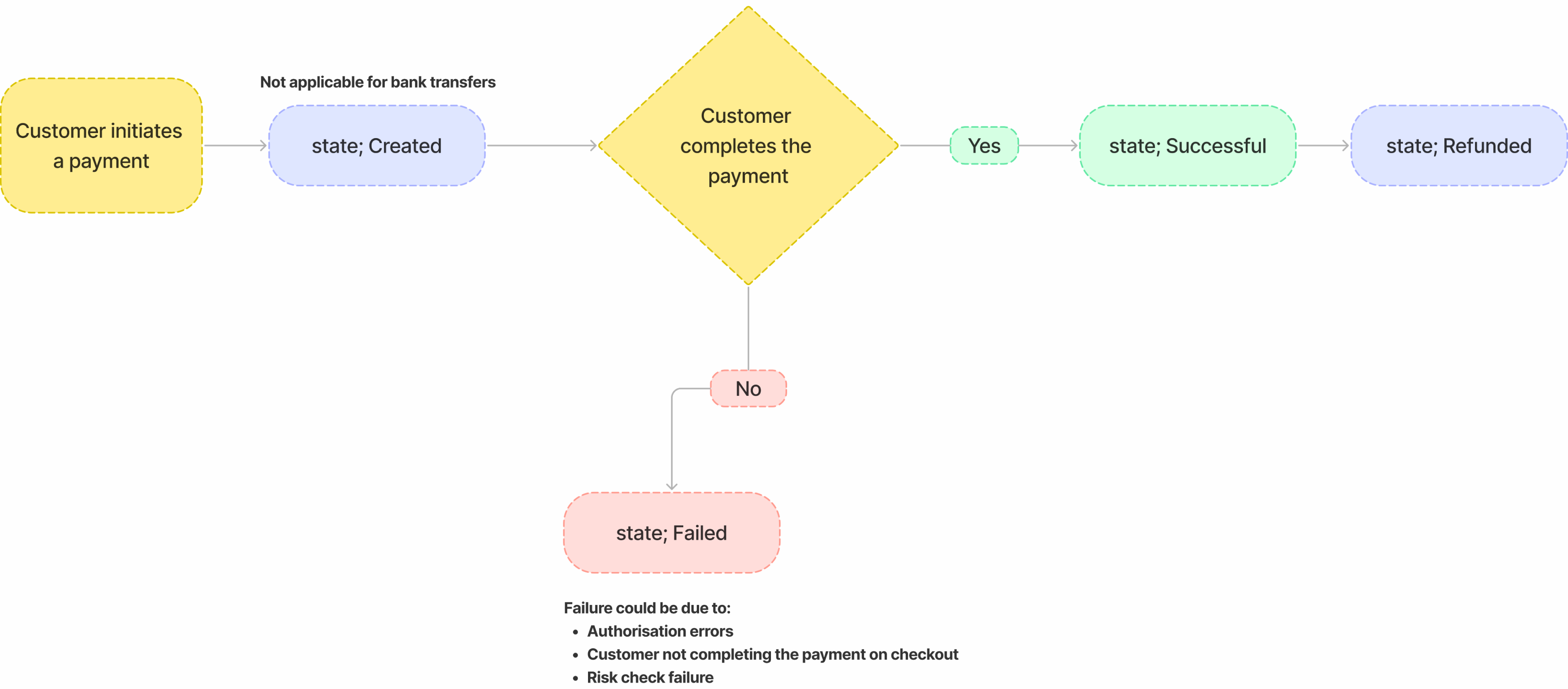

Below are the states a payment can have :-

| State | Description |

|---|---|

| In Progress | This is the initial state after payment creation, indicating that the payment has been initiated but not yet completed. |

| Success | The payment has been successfully completed by the customer. |

| Action required | Additional information is needed to process the payment. |

| Failed | The payment could not be processed successfully. |

An overview of the payment lifecycle process :-

Certain failures return an error code, a concise identifier accompanied by a short message. These codes make it simple to detect and handle issues, such as payment declines, within your integration. Refer to this Glomo error code reference for code meanings and suggested remediation steps.

| Error Code | Description |

|---|---|

| PAYMENT_DECLINED | The payment attempt was declined. This could be due to issuer rejection, risk controls, account restrictions or technical issue at bank end. Ask the customer to contact their bank or try a different method. |

| INVALID_CARD_NUMBER | The card number entered is invalid. This may be due to an incorrect number, unsupported card format, or a failed checksum validation. |

| CARD_EXPIRED | The card has expired and can no longer be used for transactions. The customer must provide a valid, non-expired card. |

| INVALID_CARD | The card is not valid for processing. This may occur due to restrictions such as card being blocked, canceled, not enabled for e-commerce, or not supported by the payment processor. |

| INVALID_CARD_CVV | The security code (CVV) provided is incorrect or invalid. The customer should verify and re-enter the correct code from their card. |

| INVALID_CARD_EXPIRY_DATE | The card expiration date provided is invalid or not formatted correctly. Ensure both the month and year are entered accurately. |

| CARD_NOT_SUPPORTED | The card is not supported for the transaction. This may be due to an unsupported card type, currency combination, or issuer restriction. |

| CARD_LIMIT_EXCEEDED | The transaction amount exceeds the card's permitted spending limit. The customer should contact their bank or use an alternate payment method. |

| INVALID_PHONE_NUMBER | The phone number provided is missing, malformed, or fails validation checks. Ensure the number is entered in the correct international format. |

| INVALID_EMAIL | The email address entered is invalid or improperly formatted. A valid email is required for the transaction or verification process. |

| INVALID_OTP | The One-Time Password (OTP) entered is incorrect or expired. The customer should retry or request a new OTP. |

| INVALID_PIN | The PIN entered is incorrect or not accepted by the card issuer. This may occur for debit or prepaid card transactions requiring PIN verification. |

| OTP_LIMIT_EXCEEDED | Too many incorrect OTP attempts have been made. The customer must wait before attempting again or use an alternate method. |

| DECLINED_DUE_TO_RISK | The transaction was flagged and declined by the system's fraud or risk engine. This may be due to suspicious behavior, geolocation, velocity checks, or internal rules. |

| DECLINED_BY_ISSUING_BANK | The card issuer declined the transaction. Common reasons include insufficient funds, invalid card status, or restrictions imposed by the bank. |

| INSUFFICIENT_BALANCE | The account linked does not have enough funds to complete the transaction. |

| 3DS_AUTHENTICATION_FAILED | The 3D Secure authentication failed. The customer should verify their identity with their bank or try again. |

| CARD_DISABLED_FOR_ONLINE_PAYMENT | The card is disabled for online payments. The customer should contact their bank to enable online transactions or use a different payment method. |

| LOGIN_FAILED | Authentication failed. The customer's credentials may be incorrect or expired. Ask them to re-enter or reset their login details. |

| REMITTANCE_NOT_COMPLIANT | The transaction was blocked by compliance validation at banks end. Please verify that customer details and purpose of remittance are valid and retry or ask the customer to contact their bank. |

| LRS_LIMIT_EXCEEDED | The transaction amount exceeds the permissible limit for remittance. The customer should reduce the amount or contact their bank. |

| PAN_MISMATCH | The PAN details provided do not match bank records. Ask the customer to verify and update PAN before retrying. |

| ACCOUNT_NOT_FOUND | No active or valid account was found for this customer. Ask them to verify account details or use a different account. |

| ACCOUNT_NOT_ELIGIBLE | The account belongs to a minor and cannot be used for remittance. Ask the customer to use a valid account. |

| INVALID_REMITTANCE_AMOUNT | The entered amount is invalid or exceeds permitted limits. Please verify and re-enter the correct amount. |

| ACCOUNT_INACTIVE | No active or valid account was found for this customer. Ask them to verify account details or use a different account. |

| INCOMPLETE_KYC | The customer's KYC details are incomplete. Ask them to complete KYC before retrying. |

| ACCOUNT_VINTAGE_FAILED | The customer's account is less than 12 months old and not eligible for remittance. Please use an alternate account. |

| INVALID_PAN | The PAN (Permanent Account Number) provided is invalid or improperly formatted. Please verify the PAN details and try again. |

| INVALID_ACCOUNT_NUMBER | The account number provided is invalid or does not exist. Please verify the account details and try again. |

| INVALID_CUSTOMER_NAME | The customer name provided is invalid or improperly formatted. Please verify the name details and try again. |

| FAILED_TO_SEND_OTP | We were unable to send the OTP to your mobile number. The Customer should and try again with correct details |

| FAILED_TO_OPEN_DOWNSTREAM_2FA_REDIRECT_URL | We encountered issue at downstream to redirect user to 2FA, The user should try again |

| TWO_FA_FAILED | Two-factor authentication failed. Please verify your credentials and try again. If the problem continues, contact support. |

| ORDER_CREATION_FAILED_AT_DOWNSTREAM | We encountered an issue while processing your transaction. Please try again in a few moments or contact support if the problem persists. |

| USER_DETAILS_MISMATCH_AT_BANK_END | The details provided do not match your bank records. Customer should provide correct details and try again |

| PAYMENT_NOT_COMPLETED_BY_USER | Payment session timed out while waiting for bank verification or customer action. Please ask the customer to retry the transaction or use an alternate payment method. |

| OTP_TIMEOUT | The OTP session has timed out. The customer should request a new OTP and try again. |

| ACCOUNT_LOCKED | The transaction failed because the customer's online banking account is locked by their bank. This can typically be confirmed when the customer attempts to log in to their bank's web or mobile application. The customer must unlock their account before retrying. |

| LOGGED_IN_ELSEWHERE | The bank rejected the payment because the customer was simultaneously logged into their account on another device. This restriction prevents concurrent logins during transaction authentication. |

| FUNCTIONALITY_RESTRICTED | The bank has applied restrictions on the customer's account, which prevent certain types of transactions. These restrictions can usually be resolved by the customer through the bank's online portal. |

| BENEFICIARY_NOT_FOUND | The designated recipient for the payment is no longer registered as a beneficiary on the customer's account. The customer must re-add or verify the beneficiary with their bank before payment initiation |

| INACTIVE_PAYMENT_SOURCE | The customer's bank account is connected but marked as inactive for payment processing. This requires reactivation or intervention by customer support before transactions can proceed. |

| BENEFICIARY_DAILY_LIMIT_EXCEEDED | The customer has exceeded the daily limit on adding new beneficiaries as set by their bank. Transactions to new beneficiaries cannot be initiated until the limit resets (usually after 24 hours). |

| EXCEEDS_DAILY_LIMIT | The transaction amount exceeds the bank's daily limit for online transfers from the customer's account. No further transfers can be processed until the next day. |

| ACCOUNT_SETTINGS_LIMIT_EXCEEDED | The bank blocked the transaction due to account-level settings that restrict payments of this type or amount. The customer must modify their account settings to enable such transactions. |

| ONLINE_TRANSFERS_DISABLED | The customer's account is not enabled for online transfers. The bank requires the customer to explicitly activate this functionality before such payments can be processed. |

| BANK_FLAGGED_DUPLICATE_TRANSACTION | The bank identified the transaction as a duplicate: multiple payments of the same amount to the same recipient within a 5-minute window. The customer must either wait or change the transaction details. |

| UNSUPPORTED_ACCOUNT_TYPE | The account selected by the customer does not support payment initiation (e.g., fixed deposit, loan, or restricted savings accounts). The customer must use a supported account type for payments. |

| PAYMENT_NOT_FOUND | Payment not found |

| DOCUMENT_UPLOAD_FAILED | Payment failed because the required document could not be uploaded. Please ask the customer to retry the upload and payment |

| CARD_NOT_SUPPORTED_ON_3DS | The card's issuer/BIN does not support 3-D Secure authentication required by this merchant flow. Customer should use another card or contact their bank to enable 3DS. |

| CLOSED_CARD_OR_ACCOUNT | The card or account has been closed and is no longer valid. The customer must provide an alternative active card. |

| PAYMENT_RESTRICTED_ON_CARD | The payment was restricted by the issuer for this card, typically observed with subscription or recurring payments. The customer may need to contact their bank or provide another card. |

| PAYMENT_CANCELLED_BY_USER | The payment was cancelled by the user before completion. |

| THREE_DS_AUTHENTICATION_FAILED | The 3D Secure authentication failed. The customer should verify their identity with their bank or try again. |