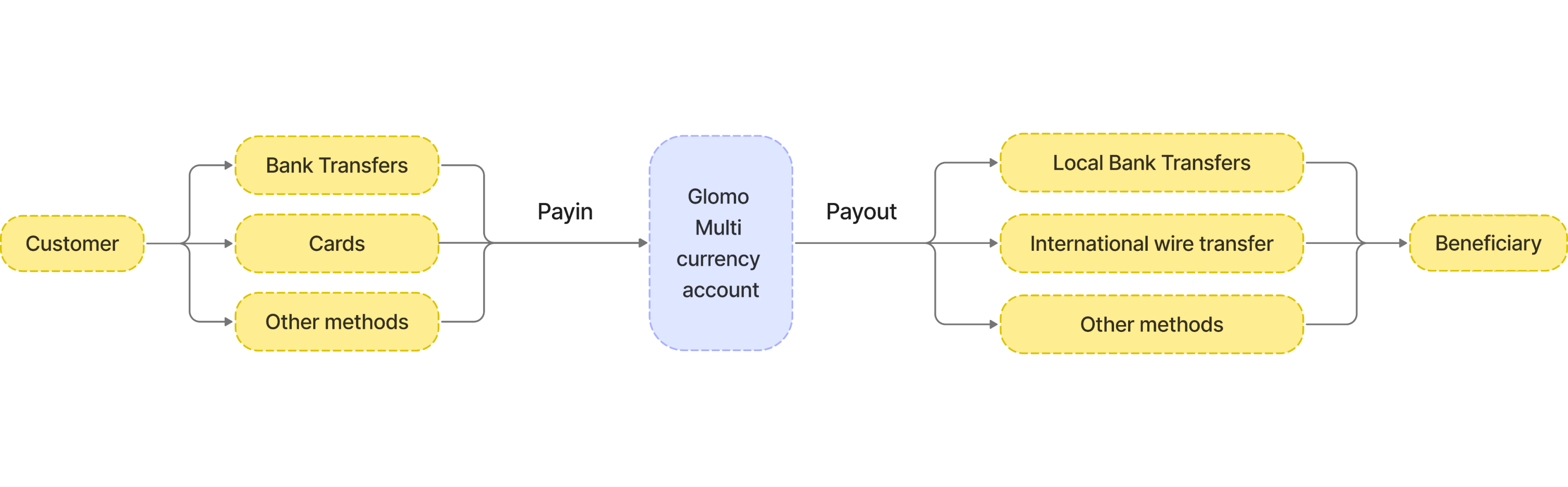

Glomo is an innovative payment service solution aiming to simplify the process of collecting, managing, and sending money across the globe. Glomo enables clients to collect payments into their multi-currency account, manage currencies, and send payments to their desired beneficiaries in the currency of their choice, ensuring compliance, transparency, and efficiency. This document serves as a guide to help you understand Glomo capabilities and integrate Glomo into your system and start accepting payments with ease.

Merchant

Merchant refers to businesses with a Glomo account. Upon onboarding to Glomo, every business will be assigned a unique merchant ID. Merchants are only onboarded and enabled for live transactions only after Glomo’s due diligence is complete.

Payin

Payin in Glomo terminology means money to be collected from consumers against purchases of goods & services from you or your underlying customers. In general, Glomo will enable its merchants to collect payments from multiple sources into their Glomo account. All such collections across merchant’s Glomo accounts are considered as Payin.

Payout

Payouts refers to sending money to your beneficiaries(vendors/suppliers/employees/others) from your Glomo account. Glomo acts as remitter of funds for both domestic and cross border money transfers.

Customer

Customer refers to the end user you are collecting money from. This collection can be done through bank transfer or any other payment method supported by Glomo.

Beneficiary

A beneficiary is the recipient of funds (vendor, supplier or any other entity) that you choose to send money to from your Glomo account.

ℹ

Glomo is available to a limited number of users at this time. If you wish to get onboarded and start using our platform, please contact us at contact@glomo.com.