The Banking, Financial Services, and Insurance (BFSI) sector, particularly those involved in securities, broking, and mutual funds, is increasingly susceptible to cybercrimes, asset misappropriation, identity theft, money laundering, and fraud. To mitigate these risks, it is essential that investors process funds only from registered bank accounts that have completed the Know Your Customer (KYC) process. This is where Third-Party Validation (TPV) becomes critical.

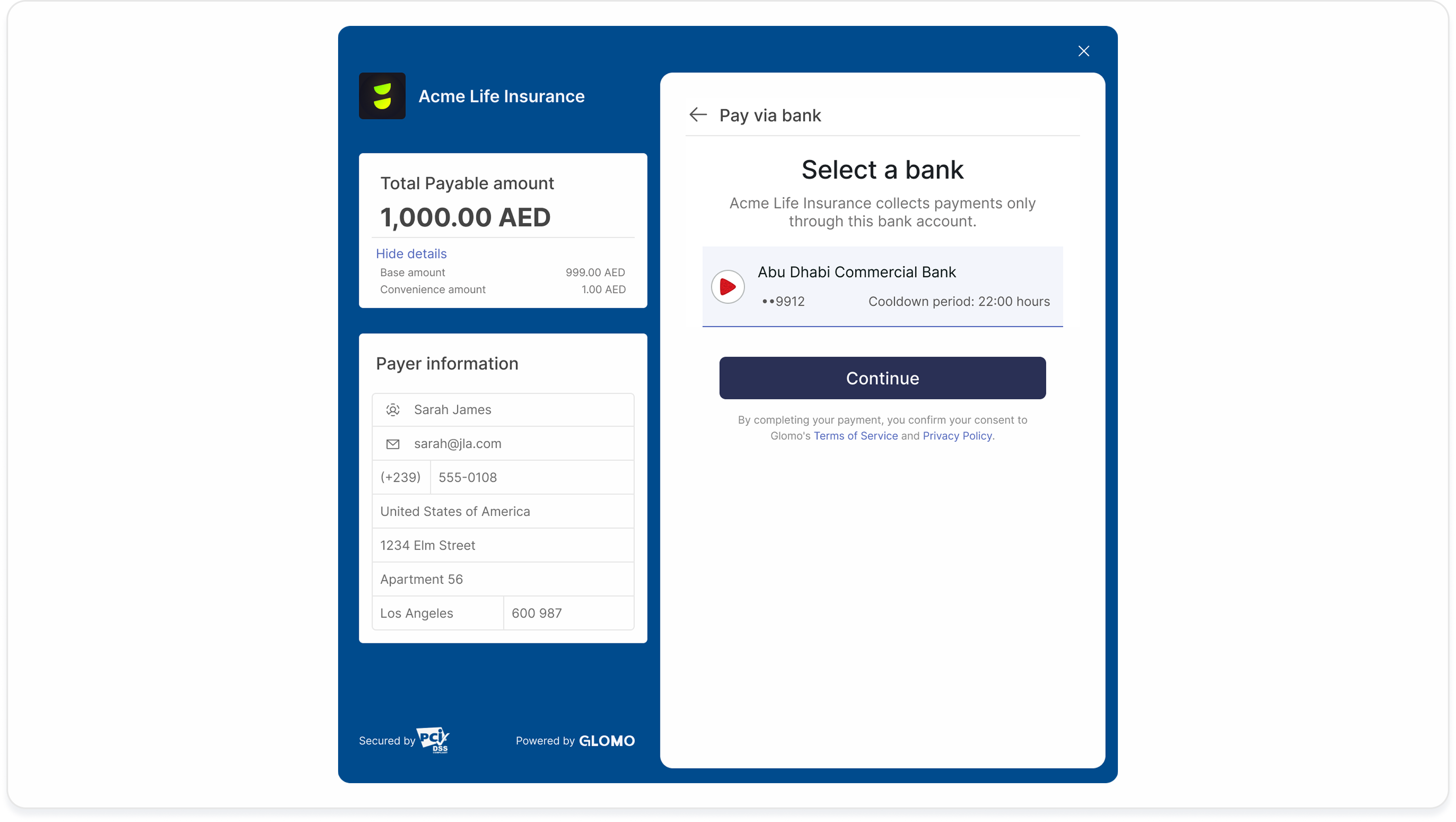

Merchant shares the registered bank during the payments to verify the customer bank account and accept the payment only if the bank details matches. Using Glomo's Third-Party Validation feature, businesses can now comply in a manner such that the customers make payments only from their registered bank accounts.

TPV is enabled on a per-business basis. To enable TPV for your account, please contact Glomo support.

Glomo supports validating the payer's/source bank account in two different ways depending on whether the flow is Pull (real-time checkout) or Push (customer sends funds externally, e.g., SWIFT transfer).

In a pull payment, the payment is initiated during checkout (real-time).

While creating a payment link / order, the merchant can optionally specify the “expected source bank account” the money should come from (i.e., the bank account Glomo should accept the payment from).

What Glomo validates:

| Check | Description |

|---|---|

| Sender name | Sender name must match the bank account holder name |

| Account Number | Sender account number must match the registered account number |

In a push payment, the customer sends funds independently (example: SWIFT transfer) to the bank account provided by the merchant/Glomo.

Since Glomo only learns the sender details after the payment is received, validation happens post-facto.

If no expected/source bank account is associated with the payment link/order, Glomo validates the sender's bank account details against the customer name.

Glomo supports validating the payer’s/source bank account in two different ways depending on whether the flow is Pull (real-time checkout) or Push (customer sends funds externally, e.g., SWIFT transfer).

If TPV returns a strong match, the payment continues through the normal payment lifecycle (no additional action needed).

If TPV returns a mismatch, weak match, or is unable to verify, the payment is moved to Action Required. The merchant can then:

- Request updated sender details (name / account number) from the customer, or

- Ask the customer to retry from the correct bank account, or

- Trigger manual review (if enabled), or

- Refund / cancel (based on corridor + merchant policy)

| Error | What it usually means |

|---|---|

| Sender details do not match with the associated details | Sender info provided does not align with the customer profile/expected payer details |

| Sender name does not match with bank account name | Bank account holder name differs materially from expected customer name |

| Sender account number does not match with bank account number | Account number used for payment differs from the expected/linked account |

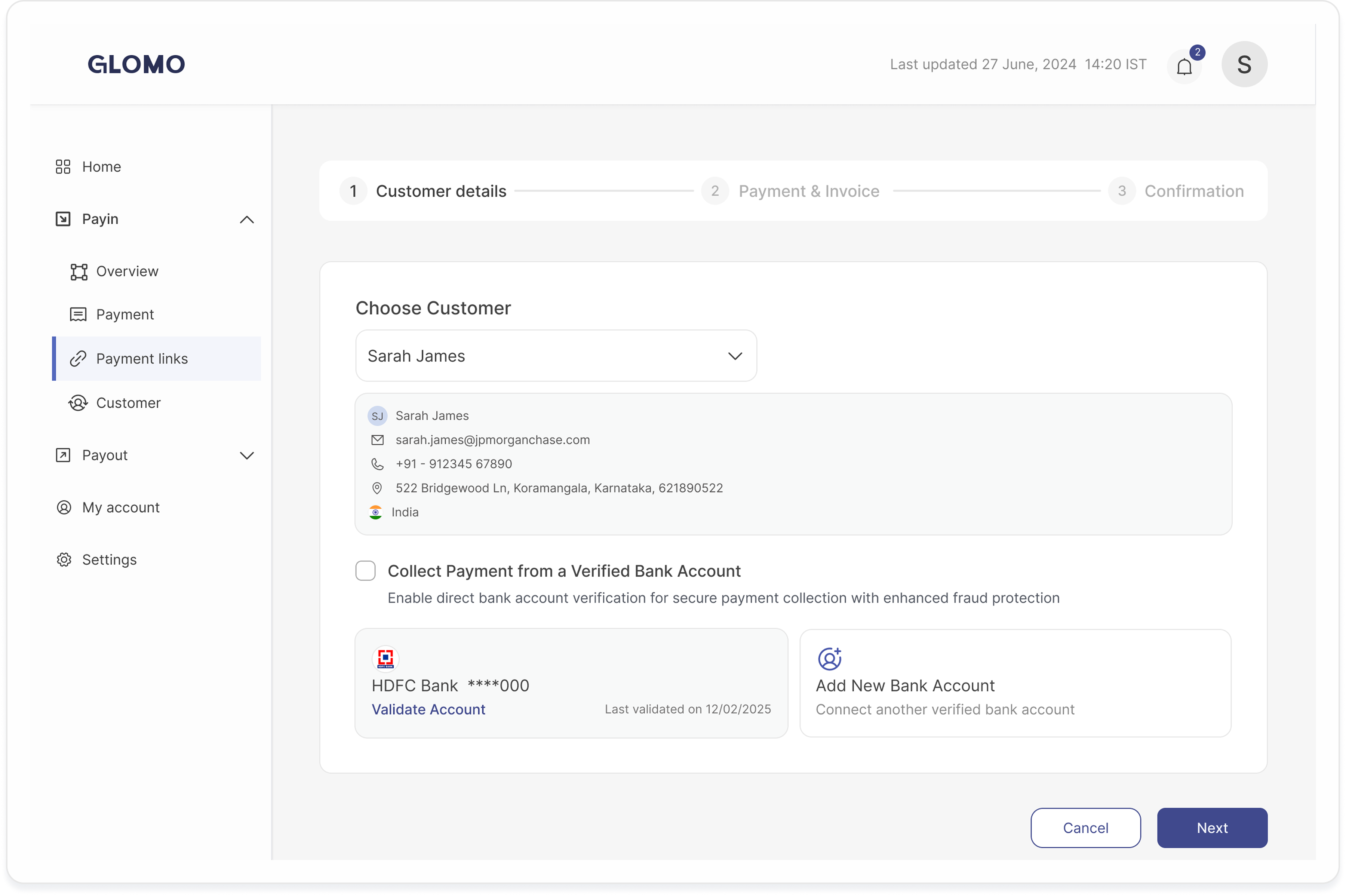

When creating a payment link through the Glomo dashboard:

Navigate to Payment Links

Enter customer details

Enter Payment amount and details

Specify bank account information

Review the information and submit to generate the payment link