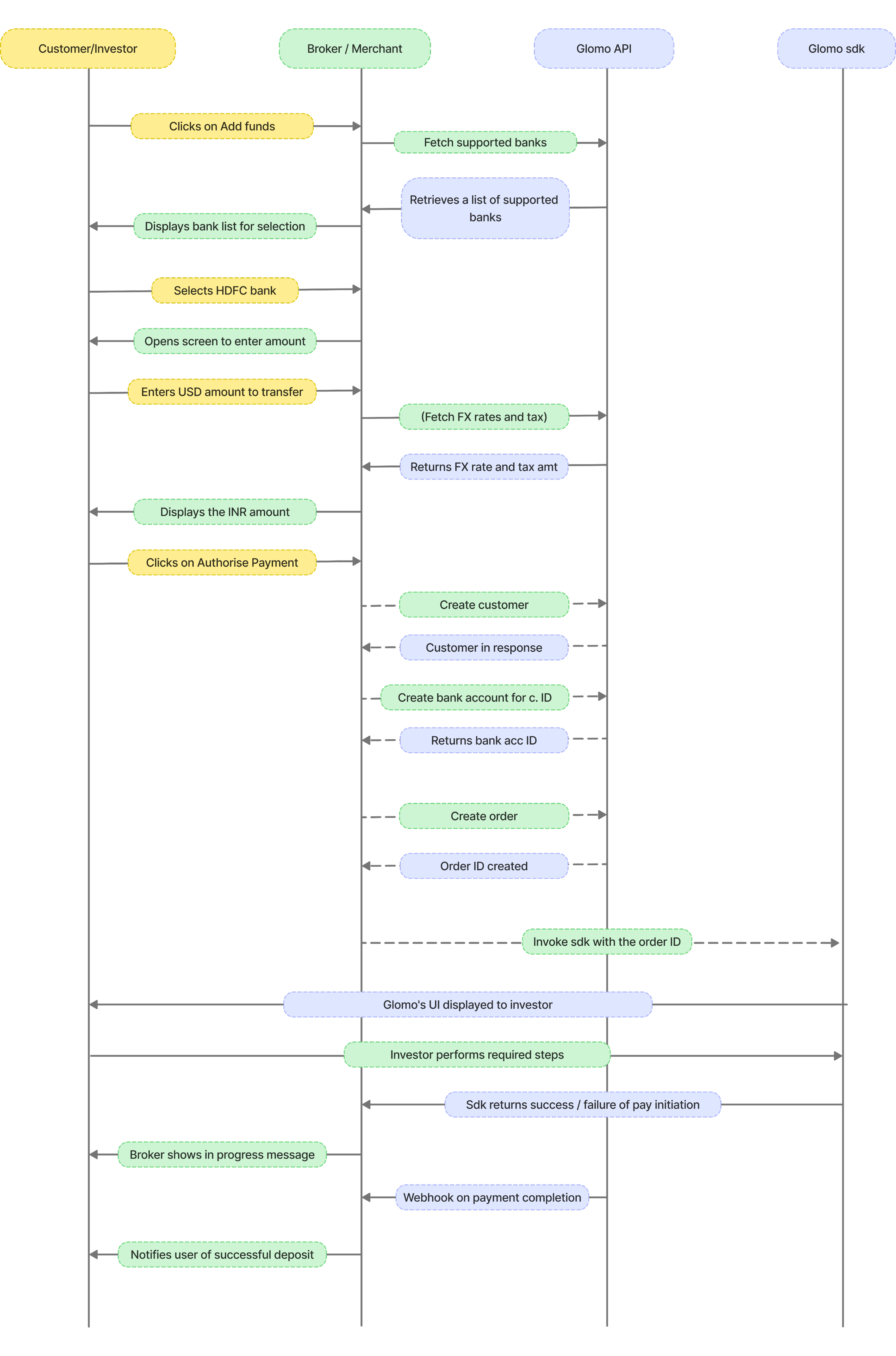

The sequence diagram below represents the interactions between the investor, broker, Glomo Web SDK, and Glomo API.

Below are the steps to integrate web sdk to and enable remittance of funds from investors

Fetch the list of banks supported on the remittance flow using this API.

GET https://api.glomopay.com/api/v1/lrs/bankscurl -i -X GET \

https://api.glomopay.com/api/v1/lrs/banks \

-H 'Authorization: Bearer <YOUR_JWT_HERE>' \

-H 'Content-Type: application/json'[

{ bank_name: 'HDFC bank', bank_code: 'hdfc' },

{ bank_name: 'Axis bank', bank_code: 'axis' },

{ bank_name: 'Federal bank', bank_code: 'fdrl' }

]Create a quote from the server by passing the amount to be remitted and the bank of the customer. Using this API you can display FX rate, tax and net USD to your user before proceeding. Please note that all currency fields are represented in minor units (e.g., cents, paisa, or equivalent subunits).

POST https://api.glomopay.com/api/v1/lrs/quotescurl -i -X POST \

https://api.glomopay.com/api/v1/lrs/quotes \

-H 'Authorization: Bearer <YOUR_JWT_HERE>' \

-H 'Content-Type: application/json' \

-d '{

"bank_code": "hdfc",

"source_amount": 100000,

"source_currency": "INR",

"target_currency": "USD"

}'{

"id": quote_7575757,

"from": {

"amount": 100000,

"currency": "INR"

},

"to": {

"amount": 1028,

"currency": "USD"

},

"fx_rate": "0.011424",

"bank_code": "hdfc",

"total_tax": "10.0",

"expires_at": "2025-06-10T09:32:04.107Z",

"created_at": "2025-06-09T09:32:04.113Z"

}Create a customer entity in Glomo’s system by adding the customer details such as contact details, name and address. To be called when the investor adds funds for the first time.

POST https://api.glomopay.com/api/v1/customercurl -i -X POST \

https://api.glomopay.com/api/v1/lrs/banks \

-H 'Authorization: Bearer <YOUR_JWT_HERE>' \

-H 'Content-Type: application/json' \

-d '{

"name": "LRS New User",

"customer_type": "individual",

"email": "customer51@glomopay.com",

"phone": "7047500604",

"address": "123 Main St",

"city": "Anytown",

"state": "Anystate",

"country": "Ind",

"pincode": "560048",

"kyc": {

"pan_number": "IXQPK8942E"

}

}'{

"id": "cust_68468bfcxaGo2",

"name": "LRS New User",

"customer_type": "individual",

"email": "customer51@glomopay.com",

"phone": "7047500604",

"address": "123 Main St",

"city": "Anytown",

"state": "Anystate",

"country": "IND",

"pincode": "560048",

"status": "active",

"created_at": "2025-06-09T07:23:40.598Z",

"updated_at": "2025-06-09T07:23:40.598Z",

"kyc": {

"pan_number": "IXQPK8942E"

}

}Create a bank account entity in Glomo’s system by adding the bank account information of the remitter.

POST https://api.glomopay.com/api/v1/customer/:customer_id/bank_accountcurl -i -X POST \

https://api.glomopay.com/api/v1/customer/:customer_id/bank_account \

-H 'Authorization: Bearer <YOUR_JWT_HERE>' \

-H 'Content-Type: application/json' \

-d '{

"bank_code": "hdfc",

"account_number": "50100114810291",

"bank_customer_id": "901008282",

}'{

"id": "acclrs_68468c03g9xt7",

"bank_code": "hdfc",

"account_number": "50100114810291",

"bank_customer_id": "901008282"

}Create a Beneficiary entity in Glomo by providing the receiver’s bank account details. This entity is required when beneficiaries are dynamic (i.e., a different beneficiary per end-user of the broker/fund, or per transaction) and should be created via API.

If there is one fixed beneficiary shared across all users, you do not need to create a Beneficiary per user in Glomo. In this scenario, the beneficiary can be configured once in the Glomo’s backend system and reused for all transactions.

POST https://api.glomopay.com/api/v2/beneficiariescurl -i -X POST \

https://api.glomopay.com/api/v2/beneficiaries \

-H 'Authorization: Bearer <YOUR_JWT_HERE>' \

-H 'Content-Type: application/json' \

-d '{

"category": "lrs",

"beneficiary": {

"name": "ACME Corporation",

"type": "business",

"email": "finance@acme.com",

"phone": "+1-555-123-4567",

"nickname": "ACME Primary Account",

"address": {

"address_line1": "123 Business Park",

"address_line2": "Suite 100",

"city": "New York",

"state": "NY",

"country_code": "USA",

"postal_code": "10001"

}

},

"bank_account": {

"account_number": "1234567890",

"name": "Citibank NA",

"swift_code": "CITIUS33",

"local_routing_number": "021000089",

"currency": "USD",

"address": {

"address_line1": "388 Greenwich Street",

"city": "New York",

"state": "NY",

"country_code": "USA",

"postal_code": "10013"

},

"intermediate_bank": {

"name": "JPMorgan Chase Bank",

"country": "USA",

"swift_code": "CHASUS33",

"account_number": "123456789"

}

}

}'{

"id": "ben_5JU9yv0lGSUP",

"name": "ACME Corporation",

"type": "business",

"category": "lrs",

"email": "finance@acme.com",

"phone": "+1-555-123-4567",

"nickname": "ACME Primary Account",

"created_at": "2025-01-15T10:00:00Z",

"updated_at": "2025-01-15T10:00:00Z",

"address": {

"address_line1": "123 Business Park",

"address_line2": "Suite 100",

"city": "New York",

"state": "NY",

"country_code": "USA",

"postal_code": "10001"

},

"bank_account": {

"account_number": "1234567890",

"name": "Citibank NA",

"swift_code": "CITIUS33",

"local_routing_number": "021000089",

"currency": "USD",

"address": {

"address_line1": "388 Greenwich Street",

"city": "New York",

"state": "NY",

"country_code": "USA",

"postal_code": "10013"

},

"intermediate_bank": {

"name": "JPMorgan Chase Bank",

"country": "USA",

"swift_code": "CHASUS33",

"account_number": "123456789"

}

}

}Initiate the payment process by creating an order from your server using your secret API keys and the previously created quote ID.

- Refer to the Authentication section for details on securely accessing the Order API.

- The

idreturned in the API response should be passed to the web sdk. This ensures the payment is securely linked to the correct order and prevents tampering.

POST https://api.glomopay.com/api/v1/orderscurl -i -X POST \

https://api.glomopay.com/api/v1/lrs/banks \

-H 'Authorization: Bearer <YOUR_JWT_HERE>' \

-H 'Content-Type: application/json' \

-d '{

"customer_id": "cust_68468bfcxaGo2",

"currency": "USD",

"amount": 100000,

"invoice_number": "RG12FF590",

"notes": {

"key1": "some note"

},

"lrs": {

"lrs_quote_id": quote_7575757,

"remittance_information": "brokerid",

"bank_account_id": "acclrs_68468c03g9xt7",

"beneficiary_id": "benef_68468c03g9xua"

}

}'{

"id": "order_68468c15mnYzq",

"customer_id": "cust_68468bfcxaGo2",

"document_id": null,

"status": "active",

"currency": "USD",

"amount": 100000,

"remaining_amount": 100000,

"already_paid_amount": 0,

"purpose_code": null,

"invoice_amount": null,

"invoice_description": null,

"invoice_number": null,

"notes": {

"key1": "some note"

},

"expires_at": "2025-09-09T07:24:05.074Z",

"created_at": "2025-06-09T07:24:05Z",

"updated_at": "2025-06-09T07:24:08Z",

"lrs": {

"lrs_quote_id": quote_7575757,

"remittance_information": "brokerid",

"bank_account_id": "acclrs_68468c03g9xt7",

"beneficiary_id": "benef_68468c03g9xua"

}

}Integrate an “Add Funds” button into your client-side interface.

- Add the provided code snippet to your website or app to launch Glomo’s sdk.

- When the user clicks the button, the checkout form will open, using the

order_idcreated using above API. - Handle payment initiation success and failure events using the provided handler functions.

- On payment completion, you’ll receive either a payment object (on successful authorisation by the user) or an error object (on failure).

- Send this information back to your server for order fulfillment or to trigger a retry if the payment failed.

<!DOCTYPE html>

<html>

<head>

<title>GlomoPay Checkout Integration</title>

</head>

<body>

<button id="pay-button">Pay with GlomoPay</button>

<script type="module">

import { LrsCheckoutApi } from 'https://lrs-checkout-sdk-prod.web.app/index.js';

document.getElementById('pay-button').addEventListener('click', async () => {

try {

// Initialize the checkout

const lrsCheckout = new LrsCheckoutApi({

publicKey: 'your-public-key-here',

orderId: 'unique-order-id-123',

});

// Handle payment success

lrsCheckout.on('payment.success', (data) => {

console.log('Payment successful:', data);

// Handle successful payment

window.location.href = '/payment-success';

});

// Handle payment failure

lrsCheckout.on('payment.failure', (data) => {

console.log('Payment failed:', data);

// Handle failed payment

alert('Payment failed. Please try again.');

});

// Handle checkout close

lrsCheckout.on('close', () => {

console.log('Checkout closed by user');

// Handle checkout modal close

});

// Open the checkout modal

await lrsCheckout.open();

} catch (error) {

console.error('Checkout error:', error);

alert('Unable to open checkout. Please try again.');

}

});

</script>

</body>

</html>The process to verify the signature can be found here.

Payment status can be tracked via the following ways

- Dashboard Monitoring: View real-time updates for all payments in the Glomo merchant dashboard.

- Payment API Polling: Programmatically check payment status using Glomo’s Payment APIs.

- Webhook Notification: Get instant notifications on payment status changes directly to your server.

If a payment journey has been completed from the checkout, the payment will appear as “In Progress” on the dashboard in the Sandbox environment.

To complete the payment journey and mark the payment as Success:

- Log in to the Dashboard

- Open the Payment Details page for the relevant payment

- Click on the three-dot (⋮) menu on the right side of the screen

- Select “Mark Payment as Success”

This action simulates the final success state of the payment.

- In production, payment success is updated automatically once Glomopay receives confirmation from the bank.

- In the sandbox environment, there is no real bank confirmation.

- To allow merchants to test and mimic the complete payment lifecycle, Glomopay provides a manual status update option.