Glomo supports Bank Transfers as a payment method for businesses to collect funds directly from customers via domestic bank rails. Glomo issues a unique virtual bank account number to facilitate payment collection via bank transfer. Customers can initiate transfers from their own banking app or at their bank branch, sending funds directly into this virtual account.

Glomo uses the virtual account number and reference number to reconcile the payment with the correct customer and merchant automatically.

Initiate Payment

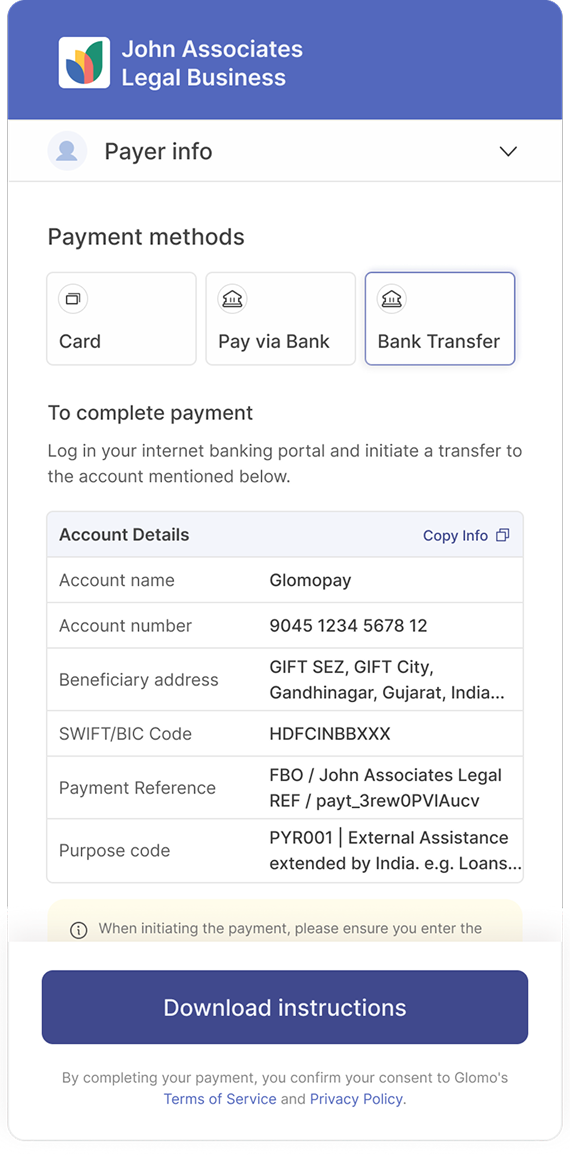

At checkout, the customer selects Bank Transfer as the payment method.

Receive Virtual Account Details

A unique virtual bank account number (and bank details) are displayed to the customer.

These details can also be shared via email or payment link for convenience.

Make the Transfer

The customer completes the transfer through their own online banking portal or by visiting their bank branch.

Funds are sent from the customer’s bank account to the virtual account assigned by Glomo.

Reconciliation

Glomo uses the unique virtual account number, reference, and other details to match the incoming transfer to the correct order or payment link.

The merchant is notified instantly once the payment is reconciled.

Payment Confirmation

The customer receives a confirmation once the transfer is detected.

Merchants can view the payment status in real time on the Glomo dashboard or via APIs.

Secure and trusted: Customers use their own banking app or branch to complete transfers.

No manual reconciliation: Virtual account numbers ensure payments are automatically mapped to the right customer or transaction.

High-value transactions: Ideal for large payments, with fewer restrictions than cards.

What is a virtual account number? A virtual account number is a unique bank account number generated for a business. Funds transferred to this number are automatically reconciled to the correct order in Glomo.

How does the customer make a payment? Customers simply log into their bank’s app or visit their branch and transfer funds to the virtual account number displayed at checkout.

How long do bank transfers take? Transfer times vary by bank, the geography of the customer, and the transfer method. In most cases, funds are reflected within minutes.

Are there limits on bank transfer payments? Glomo does not impose specific limits, but the customer’s bank may have transaction caps depending on the transfer method.

How are refunds handled? Refunds are initiated directly back to the customer’s bank account by initiating a new bank transfer to the customer’s account. Refunds typically take 1-3 business days to appear, depending on the customer’s bank.