Glomo enables businesses to securely accept card payments, supporting major networks like Visa, Mastercard, and AMEX. Payments are protected with industry-standard security protocols such as 3D Secure to minimize fraud. Transactions are processed in real-time, delivering immediate confirmation of payment status

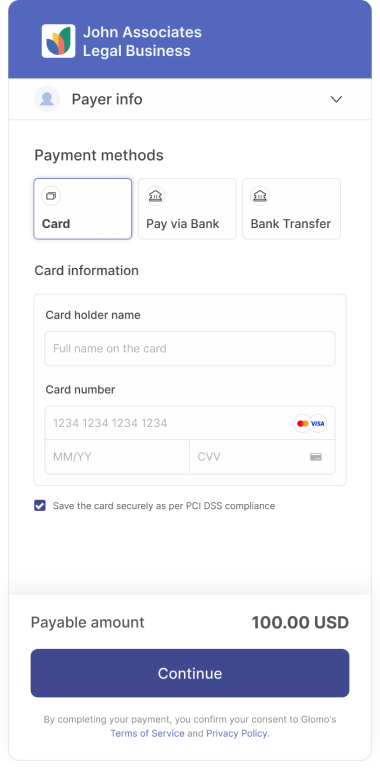

Enter Card Details

- The customer enters their card number, expiry date, CVV, and billing details on the checkout screen.

- The customer enters their card number, expiry date, CVV, and billing details on the checkout screen.

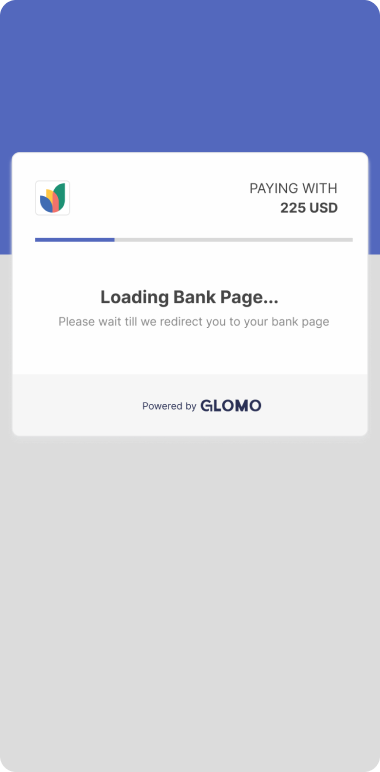

Authentication (3DS/OTP)

The customer is redirected to their bank’s authentication page.

Depending on the bank and regulations, they may be asked to complete an OTP or other 3D Secure verification

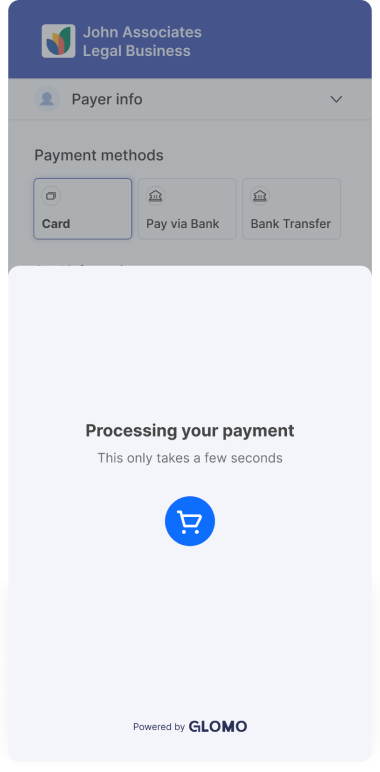

Authorization

Once authenticated, the issuing bank verifies the payment details and shares the authorization result with the card network.

Glomo receives the authorization response via its partners.

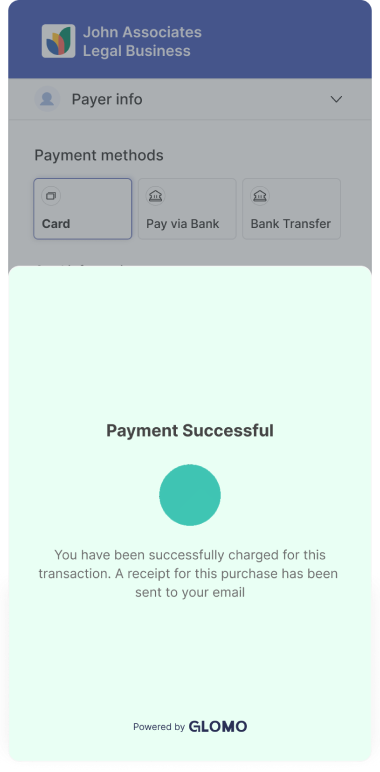

Payment Confirmation

The customer sees a confirmation screen showing whether the payment succeeded or failed, along with the option to retry the payment.

The merchant is notified instantly of the payment status through the dashboard and APIs.

Familiar payment method: Widely used by customers for both domestic and international transactions.

Instant authorization: Customers and merchants receive immediate confirmation of payment status.

Built-in protections: Support for 3D Secure and network risk checks.

Merchant tools: Real-time transaction reporting, refund initiation, and settlement tracking through the Glomo dashboard.

| Card Number | Gateway | OTP | Payment Result | Expiry Month | Expiry Year | CVV | Country |

|---|---|---|---|---|---|---|---|

| 3466 2411 1111 1111 | American Express | No | Success | any | any | any | IN |

| 3469 1222 2222 2222 | American Express | Yes | Success | any | any | any | IN |

| 3490 8811 1111 1112 | American Express | No | Failure | any | any | any | IN |

| 3790 8022 2222 2223 | American Express | Yes | Failure | any | any | any | IN |

| 4916 5311 1111 1111 | Mastercard | No | Success | any | any | any | IN |

| 4376 7022 2222 2222 | Mastercard | Yes | Success | any | any | any | IN |

| 4532 2711 1111 1112 | Mastercard | No | Failure | any | any | any | IN |

| 4556 8222 2222 2223 | Mastercard | Yes | Failure | any | any | any | IN |

| 4532 4911 1111 1111 | Visa | No | Success | any | any | any | IN |

| 4532 4422 2222 2222 | Visa | Yes | Success | any | any | any | IN |

| 4556 8911 1111 1112 | Visa | No | Failure | any | any | any | IN |

| 4597 2622 2222 2223 | Visa | Yes | Failure | any | any | any | US |

| 4111 1111 1111 1111 | Visa | No | Success | any | any | any | IN |

What card networks are supported?

Glomo supports major card networks such as Visa, Mastercard and Amex.

How secure are card payments?

All card transactions go through 3D Secure (3DS/OTP) where mandated, ensuring an extra layer of protection. Glomo is PCI DSS compliant and adopts industry leading practices in storing data.

How long does it take for refunds to reflect?

Refunds initiated by Glomo usually take 4–7 business days to reflect on the customer’s card statement, depending on the issuing bank.

Why was a payment marked as failed even though the customer was charged?

If Glomo does not receive the authorization response in time, the payment may be marked as failed. In such cases, once reconciliation confirms the success, Glomo automatically refunds the payment.

Can customers retry a failed card payment?

Yes. Customers can retry the payment by re-entering their card details or using an alternative card. If the failure was due to bank-side issues (e.g., insufficient funds), retrying after resolving the issue should succeed.

Are there transaction amount limits?

Yes. Glomo currently enforces a maximum transaction limit of USD 16,000 (or the equivalent in other currencies) for card payments. In addition, individual banks and card networks may impose their own daily or per-transaction limits. If a transaction exceeds these limits, the payment may be declined by the bank or card issuer, even if it is within Glomo’s limits.